This summer three U.S. senators released a discussion draft of legislation that would remove cannabis from the schedule of controlled substances under federal law and provide for federal taxation of cannabis products. Greg Kaufman of Eversheds Sutherland outlines the key provisions and urges lawmakers to consider data collected at the state level to get it right.

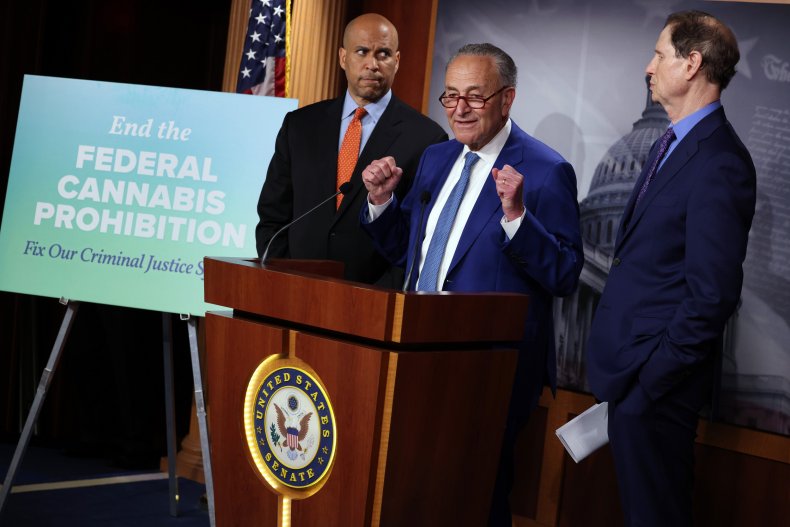

On July 14, 2021, U.S. Senators Chuck Schumer (D-N.Y.), Cory Booker (D-N.J.) and Ron Wyden (D-Ore.) released a long-anticipated bill that would provide for comprehensive federal cannabis reform.

The Cannabis Administration & Opportunity Act (CAOA or the Act) is a discussion draft rather than legislation that has been formally introduced. The sponsors seek comment from stakeholders about the discussion draft by Sept. 1, 2021. The Act, in its current form, would legalize and regulate cannabis federally, similarly to the way alcohol and tobacco are currently regulated.

It is a far-reaching proposal addressing social equity, restorative justice, research, and taxation while preserving the integrity of existing state cannabis laws. At the federal level and for purposes of interstate commerce, cannabis would no longer be a controlled substance under the Controlled Substances Act. State law would control possession, production, and distribution of cannabis. States could continue to keep cannabis illegal but would be prohibited from restricting the interstate commerce of cannabis transported through those states. While there is plenty in the CAOA to discuss and debate, the proposed tax regime deserves close attention from lawmakers, industry participants, and consumers.

With cannabis no longer being a controlled substance federally, industry participants would be freed from the crushing financial effects of tax code Section 280E. Section 280E states: